ENVEST: BRIDGING THE GAP BETWEEN MICROFINANCE AND CAPITAL MARKETS

Envest is an investment vehicle that raises capital from socially focused investors in the United States and lends to microfinance institutions (MFIs) in developing countries. These MFIs provide loans (typically averaging $650) to low-income borrowers who lack adequate access to credit from traditional sources. Microfinance lending critically impacts poverty at two interrelated levels. First, poverty is morally unacceptable, and even small loans improve the well-being and financial security of low-income families. Secondly, poverty is a recognized obstacle to an environmentally sustainable economy. Universal access to credit is one of the conditions necessary to create a socially just and environmentally sustainable economy. The unmet demand for credit from the world’s low-income population is estimated to be $320 billion. Envest’s mission is to bridge the gap between microfinance and capital markets, which are the only viable source of financial resources on the scale needed to satisfy global demand.

Envest’s niche is lending to small MFIs that are financially sound and have a strong social focus. Many small MFIs have limited access to credit from international lending institutions because of the commonly held perception that small institutions carry a high level of risk. Envest has established solid lending relationships with small MFIs in six diverse regions of the world, many of which provide the only opportunity for credit in their communities. Only a relatively few large MFIs are able to gain access to credit from capital markets. Thus, it is crucial to support the activities and growth of small MFIs so they can extend their reach and gain economies of scale. Their success is essential for the microfinance sector to grow to the point that it can provide universal access to credit.

Envest offers an investment opportunity to accredited investors. Investors receive an ownership interest in Envest Microfinance Fund, LLC. The profits of the fund are distributed to the owners annually, with a target return of 4% to 6%.

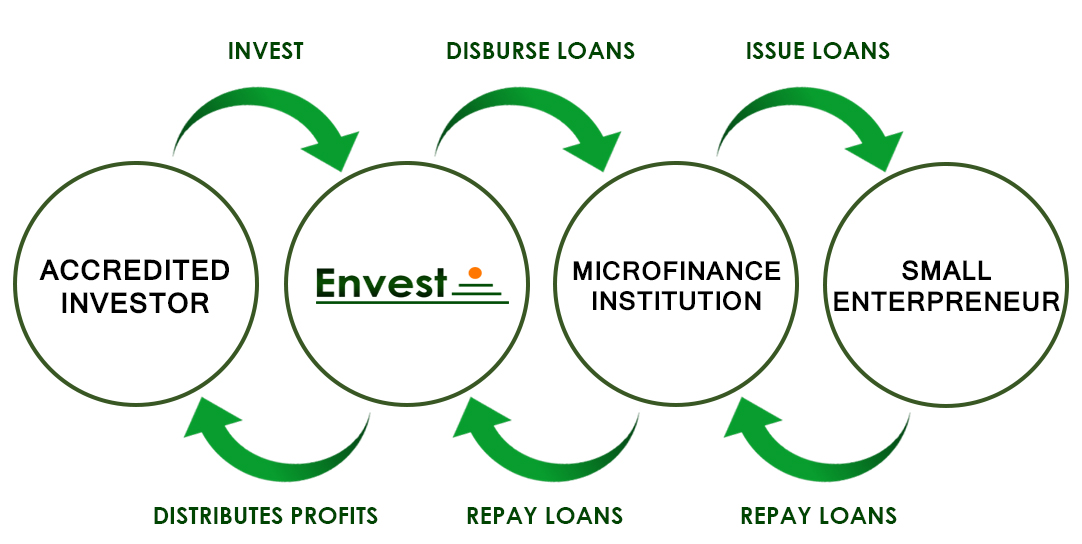

OUR MODEL

SIX STEPS TO A MORE SUSTAINABLE FUTURE

Envest’s business model is similar to a standard banking model in which a financial institution serves as the intermediary between investors and borrowers. Envest partners with MFIs to fill the role of the bank to connect investors and borrowers in different parts of the world. Careful due diligence and excellent communication are key factors to successfully implementing Envest’s business model.

WHERE WE WORK

Envest is currently active in 11 countries. The Envest portfolio is diversified across 20 independent microfinance institutions located in six geographic regions: Central America, South America, Sub-Saharan Africa, Eastern Europe, Central Asia, and South Asia. As microfinance markets change, Envest adapts the concentration of its portfolio by country.

Click on the map below to find statistics regarding the countries where we work.

OUR PARTNERS

SOCIAL IMPACT

Envest lends to microfinance institutions (MFIs) that are often forced to turn away deserving borrowers due to the lack of lending capital. Envest is often one of very few international institutions lending to an MFI, and sometimes it is the only foreign lender. Often, these MFIs represent the only viable source of credit to borrowers.

Envest’s partner MFIs are governed and operated by residents of the country, which results in local solutions to local problems. Envest respects the professionalism and sovereignty of its partners. The need and appropriateness of each loan is determined by analysts at the MFI who are from the area and are familiar with the local economy. Access to credit can mean increased income, gender equality in a household, children attending school, or electricity from solar panels.

SOCIAL IMPACT SUCCESS STORIES

INVESTING IN AGRICULTURE

Quest Financial

Mr. and Mrs. Mauto are maize farmers in Guruve, Zimbabwe. They are participating in Quest's drylands farming program and are pleased with the excellent growth of their crops this season. They hope to continue participating in Quest Financial's projects. Quest provides agricultural financial services to many farmers in the region. So far, Quest's drylands farming program has benefitted over 900 farmers in the Guruve District in Zimbabwe. Quest regularly visits clients to monitor progress and receive suggestions for improvements to their programs. They also provide financial literacy programs for rural clients.

INVESTING IN MANUFACTURING

Pana Pana

Gilbert Henry Wrights is a small business owner and a long time borrower from Pana Pana, a microfinance institution in Nicaragua. He opened a small furniture manufacturing and repair operation with two business partners. Using the initial loan from Pana Pana, Wrights purchased raw materials and also used the loan to finance the purchase of power tools like an electric sander and an electric screwdriver. He and his partners were able to repay their first Pana Pana loan with revenue generated from their furniture sales. Wrights received an additional loan, which he used to expand his furniture business. The funds were used to replace broken power tools, allowing Wright and his partners to continue building new products. Wrights was also able to increase productivity by purchasing a tablesaw. With the next loan from Pana Pana, Wrights plans to purchase materials to build a display case for their best selling products.

INVESTING IN SMALL BUSINESS

Pana Pana

Five women form a lending group in Tuapi, a fishing village along Nicaragua's Atlantic coast. Together, they received their first loans from Envest's partner, Pana Pana, an MFI serving one of Nicaragua's poorest regions. Before having access to credit, these women were entirely dependent on their husbands who fished the waters off the coast of Tuapi and sold their fish in the region's capital of Puerto Cabezas.

After receiving their loans, the women used the money to buy their husband's fish to sell in the city. This allowed the men to dedicate more time to fishing. It also meant the income entered the family through the women, which elevated them to equal partners with their husbands. More recently, the women have each opened small pulperias (mom and pop shops) in their homes, further increasing and diversifying their families' incomes. The increased income has made it easier for all five families to meet their basic needs and keep their children in school.