INVESTMENT OPPORTUNITIES

Envest offers a meaningful opportunity for accredited investors to make a difference in the world through microfinance. Of every investment that comes into Envest, 100% is used to make loans to our microfinance partners, who then use the money to make hundreds of small loans to their borrowers. As the borrowers repay, your investment is lent out again and again, making a difference for countless families around the world. Envest raises the funds it lends to microfinance institutions through equity investments.

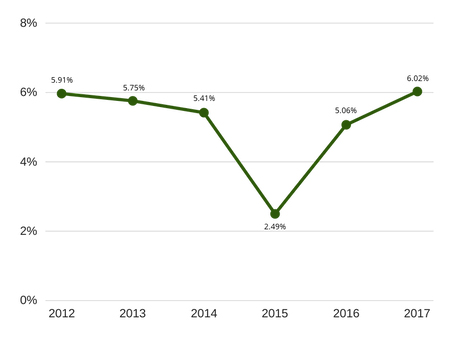

Along with the strong social return, Envest strives to offer meaningful financial returns that will contribute to the financial resilience of your portfolio. Envest targets a 5-6% annual return on investment, and has met this target five out of six years.

Due to current securities laws, Envest can sell securities to accredited investors* only. The minimum investment value per individual is $25,000.

To obtain Envest’s Private Placement Memorandum or to learn more about the Envest’s microfinance model, enter your contact information in the form to the right or contact Jon Bishop by phone at (608) 216-9898 or by email at jonbishop@envestmicrofinance.com. **

*U.S. Securities Laws provide that an accredited investor is any natural person who:

earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR

has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

**Prospective investors should consult their own independent counsel or financial advisor as to legal, tax and similar matters concerning an investment.

FINANCIAL OVERVIEW

Total Loan Portfolio: $4.18M

Targeted Annual Return to Investors: 5-6%

Average Annual Return to Investors: 5.12%*

Average Annual Portfolio Growth: 29%

Loss Rate: 1.33%