CASE STUDY: RAFODE

Rafode is located in Kisumu, Kenya and serves six communities in the impoverished southwestern part of Kenya. Rafode provides micro-business loans to rural and urban borrowers, 70% of whom are women. Rafode has an internal practice of regularly evaluating its culture, practices, and products to promote increased participation by women.

Importantly, 20% of the loans are for solar panels and high efficiency wood stoves. These improve the health, wellness, and productivity of Rafode borrower families. Since its founding in 2006, Rafode has maintained its focus on providing small loans to very low income borrowers, whereas many other MFIs in Kenya have shifted to larger loan sizes that are not practical for borrowers at the lowest end of the economic spectrum.

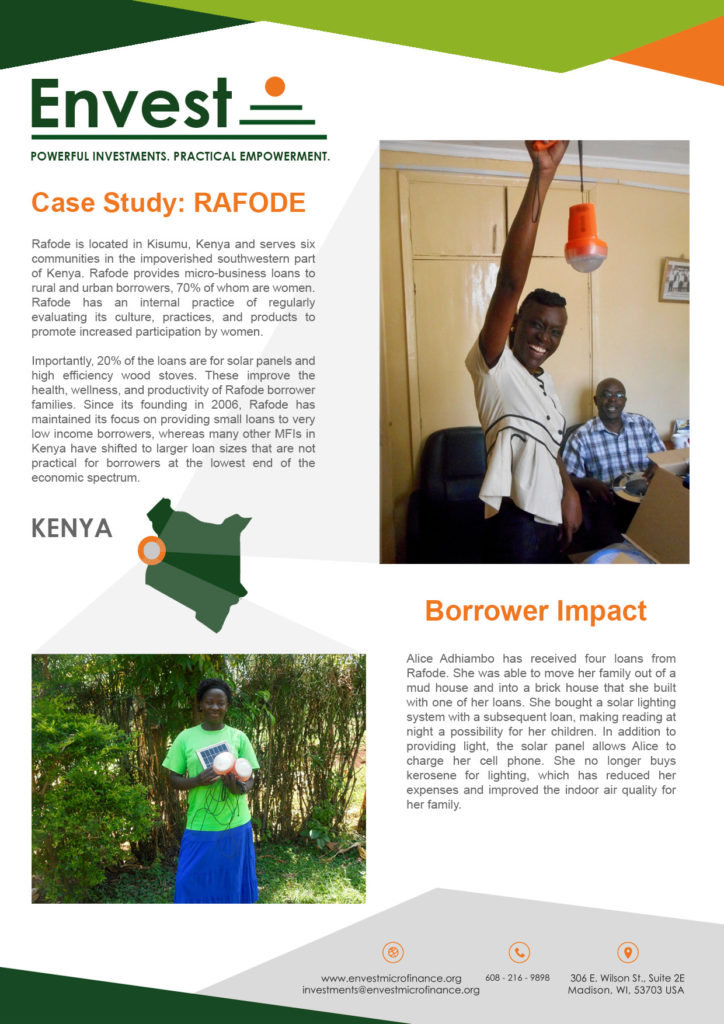

Alice Adhiambo has received four loans from Rafode. She was able to move her family out of a mud house and into a brick house that she built with one of her loans. She bought a solar lighting system with a subsequent loan, making reading at night a possibility for her children. In addition to providing light, the solar panel allows Alice to charge her cell phone. She no longer buys kerosene for lighting, which has reduced her expenses and improved the indoor air quality for her family.