AT A GLANCE

For us impact investing means making sure that everyone benefits. Investors see a return on capital that is loaned responsibly in countries with a critical demand for credit, while borrowers have access to affordable finance that helps the local community and the environment. The impact stories below show our MFI partners’ commitment to lending to traditionally marginalized borrowers, such as women and rural residents.

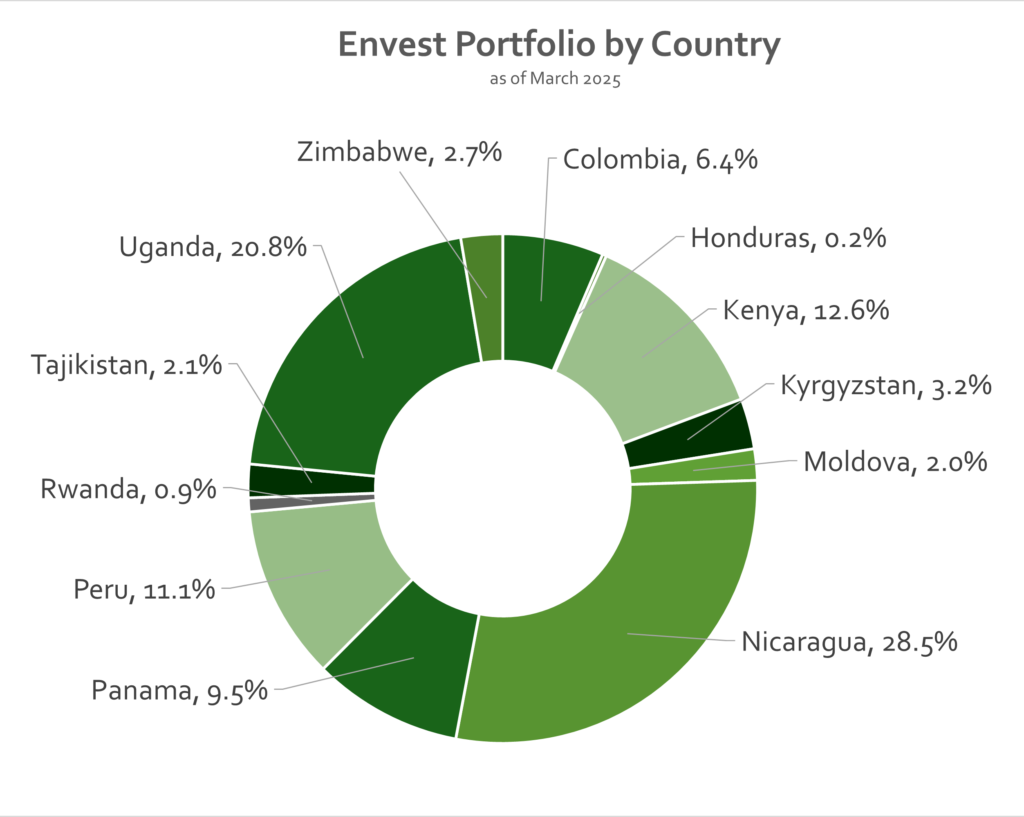

Our portfolio is diversified across 20+ carefully selected partner MFls in countries where there is limited access to credit. For about half of our partners Envest was the first foreign creditor to provide them with a much-needed infusion of cash in their local communities.

IMPACT STORIES

Ann Wangari lives in Thika, Kenya. She is a 54-year-old farmer, wife, and mother of seven. Ann has taken several loans from VEP, her local microfinance organization, to buy solar lights, a fuel efficient cookstove, a solar power bank, and a water tank. Ann family’s life was transformed by having access to clean water and reliable lighting. Small MFIs like VEP are often unable to access funding from Kenyan banks. We partner with VEP because it’s a strong MFI that promotes clean energy, with a powerful impact on Ann’s entire community and the environment.

Ann Wangari lives in Thika, Kenya. She is a 54-year-old farmer, wife, and mother of seven. Ann has taken several loans from VEP, her local microfinance organization, to buy solar lights, a fuel efficient cookstove, a solar power bank, and a water tank. Ann family’s life was transformed by having access to clean water and reliable lighting. Small MFIs like VEP are often unable to access funding from Kenyan banks. We partner with VEP because it’s a strong MFI that promotes clean energy, with a powerful impact on Ann’s entire community and the environment.

Heder Lozano is a 36-year-old teacher from Peru who has a stall in the market. His business provides a steady income for him and his elderly parents. However, Heder dreams about growing his business enough to hire staff, which will free him to go back to teaching. Heder is a client of Inclusiva, an MFI with some of its branches being the only existing financial institution in the region. Inclusiva has a larger loan demand than it can meet with its deposits. An Envest loan ensures that Inclusiva reaches remote rural borrowers that have been historically financially excluded.

Heder Lozano is a 36-year-old teacher from Peru who has a stall in the market. His business provides a steady income for him and his elderly parents. However, Heder dreams about growing his business enough to hire staff, which will free him to go back to teaching. Heder is a client of Inclusiva, an MFI with some of its branches being the only existing financial institution in the region. Inclusiva has a larger loan demand than it can meet with its deposits. An Envest loan ensures that Inclusiva reaches remote rural borrowers that have been historically financially excluded.

Beth Tumuhairwe is a 53-year-old widow who owns a hair salon and banana plantation in Western Uganda. The income from the salon and the banana plantation allowed her to raise three children all by herself. When we met Beth in 2023, she said that she started the salon because “business was in her nature”. She took a US$1,030 loan from Kigarama Farmers SACCO to buy supplies for her business. Beth is also training young women to become hair stylists and how to use hair products safely: “They will have a chance to learn a good skill and make some money for themselves”.

Beth Tumuhairwe is a 53-year-old widow who owns a hair salon and banana plantation in Western Uganda. The income from the salon and the banana plantation allowed her to raise three children all by herself. When we met Beth in 2023, she said that she started the salon because “business was in her nature”. She took a US$1,030 loan from Kigarama Farmers SACCO to buy supplies for her business. Beth is also training young women to become hair stylists and how to use hair products safely: “They will have a chance to learn a good skill and make some money for themselves”.

Women disproportionately face financial access barriers, especially if they live in rural areas. Lucy Wambui, 32, is a single mother of three children in rural Kenya. Thanks to a loan from her local microfinance organization called VEP, Lucy was able to purchase a solar panel and a water tank to harvest precious rainwater. Her kids can now read after sunset thanks to a solar powered lamp. We seek partnerships with organizations that share our vision of a socially just and environmentally sustainable world.

Women disproportionately face financial access barriers, especially if they live in rural areas. Lucy Wambui, 32, is a single mother of three children in rural Kenya. Thanks to a loan from her local microfinance organization called VEP, Lucy was able to purchase a solar panel and a water tank to harvest precious rainwater. Her kids can now read after sunset thanks to a solar powered lamp. We seek partnerships with organizations that share our vision of a socially just and environmentally sustainable world.

Hannah Katana Lule (pictured with her husband and daughter) is a 42-year-old businesswoman in Kampala, Uganda. She moved to the city as a teenager but was not able to open her own shop until five years ago when she got a loan from DMF, an Envest partner MFI. She named her shop Lule Investments, and when we met with her, she called it “a true family business”. The income from the shop puts food on the table for her five children. It also made her dream of becoming a homeowner come true.

Hannah Katana Lule (pictured with her husband and daughter) is a 42-year-old businesswoman in Kampala, Uganda. She moved to the city as a teenager but was not able to open her own shop until five years ago when she got a loan from DMF, an Envest partner MFI. She named her shop Lule Investments, and when we met with her, she called it “a true family business”. The income from the shop puts food on the table for her five children. It also made her dream of becoming a homeowner come true.

Young people in Uganda face difficulties in finding employment that offers learning opportunities. Naomi Kobusingye (far right) strives to make more of these opportunities available for young women in her community. Naomi, 49 years old, owns a tailoring shop in Western Uganda where she sews women’s and children’s clothing. Thanks to a loan from an Envest partner, Kigarama Farmers SACCO, Naomi purchased additional sewing machines for her business. Now Naomi is teaching teenagers, including school dropouts, how to sew and earn an independent income.

Young people in Uganda face difficulties in finding employment that offers learning opportunities. Naomi Kobusingye (far right) strives to make more of these opportunities available for young women in her community. Naomi, 49 years old, owns a tailoring shop in Western Uganda where she sews women’s and children’s clothing. Thanks to a loan from an Envest partner, Kigarama Farmers SACCO, Naomi purchased additional sewing machines for her business. Now Naomi is teaching teenagers, including school dropouts, how to sew and earn an independent income.

MFI PROFILES

We provide financing to local microfinance institutions (MFls) that generate social and environmental benefits in 12 countries. Click on the MFI profiles below to learn about their incredible impact on marginalized communities, which include refugees, women, and rural population.

MFI PARTNER VIDEO

Watch this video about our MFI partner institution in Nicaragua, called Pana Pana. Envest has been lending to Pana Pana since 2014. The majority of their borrowers are indigenous and 70% are women, with the average loan size of $611. In addition to financial services, this MFI administers water and sanitation projects.

Click here to learn about other MFI partners we work with.